Unveiling the Investment Landscape of Target-Date Funds: A Deep Dive

Target-date funds (TDFs) have gained immense popularity as a straightforward investment solution for retirement planning. Their allure lies in their simplicity: investors choose a fund with a target retirement date, and the fund’s asset allocation automatically adjusts over time to become more conservative as the target date approaches. However, understanding the underlying investment components within these funds is crucial for making informed decisions. This comprehensive exploration delves into the typical asset classes and investment strategies employed within TDFs.

The Core Components: A Multi-Asset Approach

TDFs are inherently multi-asset class vehicles, strategically combining various investments to achieve diversification and manage risk effectively throughout the investment lifecycle. The specific asset allocation varies depending on the fund’s target date and the investment manager’s philosophy, but several common components consistently appear.

1. Equities (Stocks): The Growth Engine

- Domestic Equities (US Stocks): A significant portion of most TDFs is allocated to US equities, representing a core exposure to the domestic economy’s growth potential. These investments typically span across various market capitalizations (large-cap, mid-cap, small-cap), offering diversification within the US market.

- International Equities (Non-US Stocks): To further diversify geographical risk, TDFs often include a percentage allocated to international equities. This exposure helps to mitigate dependence on the performance of the US market and provides access to global growth opportunities. These holdings can further be broken down into developed and emerging market equities.

- Equity Style Diversification: Within both domestic and international equity holdings, TDFs often incorporate diversification across various equity styles, such as value stocks (undervalued companies), growth stocks (companies expected to experience high growth), and blend stocks (a combination of value and growth characteristics). This approach aims to capture different market segments and potentially enhance returns.

2. Fixed Income (Bonds): Providing Stability and Income

- US Government Bonds: These bonds are considered low-risk investments backed by the full faith and credit of the US government. They provide stability and serve as a safe haven during periods of market volatility. TDFs typically include a significant allocation to these bonds, particularly as the target date nears.

- Corporate Bonds: Corporate bonds offer potentially higher yields compared to government bonds but carry a greater degree of credit risk. TDFs may include corporate bonds, but the allocation is usually managed carefully to balance risk and return, with a focus on investment-grade bonds (less risky).

- Municipal Bonds (Munis): These bonds are issued by state and local governments and often offer tax advantages for investors in the same jurisdiction. TDFs might include a smaller allocation to munis depending on the investor’s tax bracket and the fund manager’s strategy.

- Inflation-Protected Securities (TIPS): Treasury Inflation-Protected Securities (TIPS) adjust their principal value with inflation. Including TIPS helps to protect the portfolio’s purchasing power against inflation, particularly important for long-term retirement planning.

3. Real Estate: Diversification and Inflation Hedge

- Real Estate Investment Trusts (REITs): REITs are companies that own or operate income-producing real estate. TDFs often include a modest allocation to REITs, which can offer diversification and potentially act as an inflation hedge, as real estate values tend to rise with inflation.

- Real Estate Funds: Some TDFs may invest in publicly traded real estate funds, which provide exposure to a broader range of real estate assets without direct property ownership.

4. Alternative Investments (Often Limited): Seeking Enhanced Returns

While less common in mainstream TDFs, some funds might include a small allocation to alternative investments, seeking to enhance returns and potentially reduce correlations with traditional asset classes. These may include:

- Private Equity: Investments in privately held companies, offering potential for higher returns but with lower liquidity.

- Commodities: Investments in raw materials like gold, oil, and agricultural products, which can serve as an inflation hedge and diversify the portfolio.

- Hedge Funds (rare): While less prevalent, some more sophisticated TDFs might include a small allocation to hedge funds, aiming for absolute returns and reduced correlation to traditional markets.

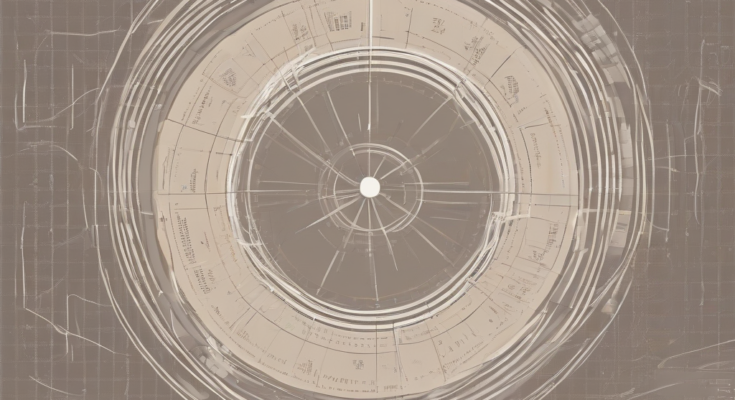

The Lifecycle Approach: Asset Allocation Over Time

A defining feature of TDFs is their lifecycle asset allocation strategy. As the target date approaches, the fund’s asset allocation gradually shifts from a higher allocation to equities (growth assets) to a higher allocation to fixed income (conservative assets). This risk reduction aims to protect accumulated savings closer to retirement.

- Early Years (Longer Time Horizon): In the early years, TDFs typically hold a significantly larger percentage of equities, reflecting a higher risk tolerance and a longer time horizon to recover from potential market downturns. This aggressive allocation aims to capitalize on the higher growth potential of equities.

- Middle Years (Intermediate Time Horizon): As the target date approaches, the allocation to equities gradually decreases, while the allocation to fixed income increases. This shift represents a moderate risk approach, aiming to balance growth with capital preservation.

- Later Years (Shorter Time Horizon): Closer to the target date, the equity allocation is significantly reduced, and the majority of the portfolio is shifted to fixed income and other conservative assets. This conservative approach prioritizes capital preservation and minimizing risk ahead of retirement.

Variations and Considerations

It is crucial to recognize that not all TDFs are created equal. Variations exist based on the fund manager’s investment philosophy, target audience, and risk tolerance. Some key considerations include:

- Investment Management Style: Different fund managers employ different investment strategies within their TDFs. Some might focus on active management, aiming to outperform the market, while others utilize passive management, tracking a specific market index.

- Expense Ratios: Expense ratios represent the annual cost of managing the fund. Lower expense ratios are generally preferred, as they result in higher net returns for investors.

- Target Date Range: TDFs typically offer a range of target dates, reflecting different retirement timelines. Choosing the appropriate target date is crucial, aligning with the investor’s personal retirement plans.

- Risk Tolerance: While TDFs automatically adjust their asset allocation over time, investors should still consider their own risk tolerance. Some TDFs may have a more aggressive or conservative glide path compared to others.

- Transparency and Disclosure: It is essential to carefully review the fund’s prospectus and other disclosures to fully understand the investment strategy, asset allocation, fees, and risks involved.

In conclusion, target-date funds provide a convenient and diversified investment approach for retirement planning. However, understanding the underlying asset classes and the lifecycle asset allocation strategy is crucial for making informed decisions. By carefully evaluating the fund’s characteristics and aligning them with individual financial goals and risk tolerance, investors can leverage TDFs effectively towards a secure retirement.